- #Easy personal budget template excel how to#

- #Easy personal budget template excel tv#

- #Easy personal budget template excel free#

Cheers.This is the best way to budget because you will be determining what the dollars from each paycheck are actually and literally going to be paying for.

#Easy personal budget template excel free#

And duplicate this file into 12 excel workbooks, so you can have your own monthly personal budget.įeel free to modify, but send me a feedback if you found some errors. Save this excel template with name of the month, for example January-2011.

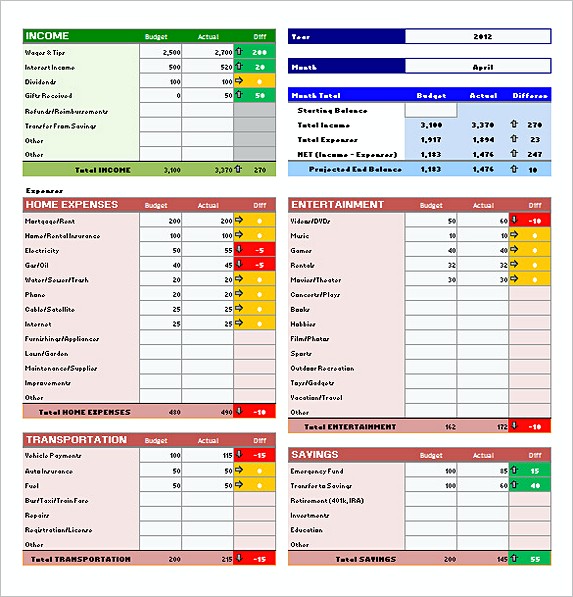

And there is a budget vs income/expenses column in the first worksheet, so you can see you are over or under budget. You can see the sum of those amount in the first worksheet. Make sure that you type your income and expenses within one month period. Type your daily income and expenses based on dates. In the second sheet, there are two tables, income table and expenses table. Once you type the category, it will become a selection category in the second sheet (income and expenses tracker sheet). The category is supposed to help you had a structural thought on managing your expenses. The idea of this template is to balance your income with your expenses. There are many references available on categorizing expenses, but you don’t have to be bounded with that. Don't worry about making mistakes or getting confused on categories. Remember and categorize it in words that you understand or based on thought. Try not to be precise as a financial people. The first sheet is a budget sheet where you can type your income and expenses category and fill your budget. There are only two sheets in this template. This template is a simple personal budget template that should give you better understanding on making a monthly budget without complicated thought.

#Easy personal budget template excel how to#

I have made household budget about one year ago, and it needs some times to understand how to use the template. However, the long term benefits of financial freedom, debt free living, and a comfortable retirement far outweigh any potential difficulty. At times this will be very difficult, particularly if a person has established the habit of freely spending without a second thought. This in and of itself will do a person absolutely no good if he does not discipline himself to stick to it. It is important to realize that simply creating a budget is not enough. This acts as a safeguard against getting in over your head financially. Whether it’s a house, a car, or a new TV, a person will be able to determine whether or not a certain purchase will fit within their monetary constraints. Another great benefit is that a budget portrays an accurate idea of how much an individual can actually afford to pay for various consumer items. There are many methods available on how to categorize the expenses, which categories should have higher allocation, and many other considerations which should make people finally understand that they don’t have much money to cover all expenses. A budget will help prevent this from happening by making a person accountable for the money that they spend. How many times have you taken money from the ATM only to realize a couple of days later that it is gone? There is always situation where you have difficulties to remember how exactly you spent the money, and often times this money is wasted on unnecessary purchases. Many people have no idea exactly where or how they spend a good portion of their money. One tool to help people manage their expenses is a personal budget. In order to reverse this trend, people need to become more responsible with their spending patterns. Because people tends to spend their money as soon as they get paid and think about saving it several days before getting paid again. We saw any marts, restaurants, stores are more quiet on those weeks comparing with previous weeks. That is the reason people or family are sort of money every last week in every month. Some people don’t know how to make it, some others don’t have intention on limiting their expenses.

There are very few people who understand the needs of budgeting their expenses. A good budget will consider all the factors above and still have some savings on income by the end of month. Flexible expenses are expenses that related with variable amount of money that has to be spent based on people behavior.

#Easy personal budget template excel tv#

For example: mortgage, school fee, cable TV etc where the money being spent is fixed per month. Fixed expenses are usually obligation expenses. The income must cover all expenses, fixed and flexible expenses, where fixed expenses become top priority to be fulfilled every month. The limitation is usually based on income being received. The most common period used as a reference is one month period. What is a personal budget definition? Refer to several internet sites, a personal budget is a financial plan that limits the amount of money that will be spent on any expenses category in any period of time.

0 kommentar(er)

0 kommentar(er)